In May 2016, the National Credit Regulator briefed the Portfolio Committee on the feasibility of a debt forgiveness programme. Currently over 10 million South Africans have impaired credit records and this prompted the Committee to engage with stakeholders in November 2016 on the viability of a debt relief programme. Inputs were made by the Debt Counsellors Association of South Africa (DCASA), COSATU and the Banking Association of South Africa.

DCASA stated that a solution for the high level of household debt is critical for South Africa. The Banking Association of South Africa (BASA) agreed, but did not support the principle of ‘blanket’ debt forgiveness. According to BASA, one of the banking system’s principles is to efficiently and legally lend money to borrowers and to collect repayments from borrowers to settle the loans. Any failure to perform on this principle will have severe consequences for the industry and economy, will increase risk to depositors/savers, will impose a cost on society, and will limit credit providers’ ability to extend credit.

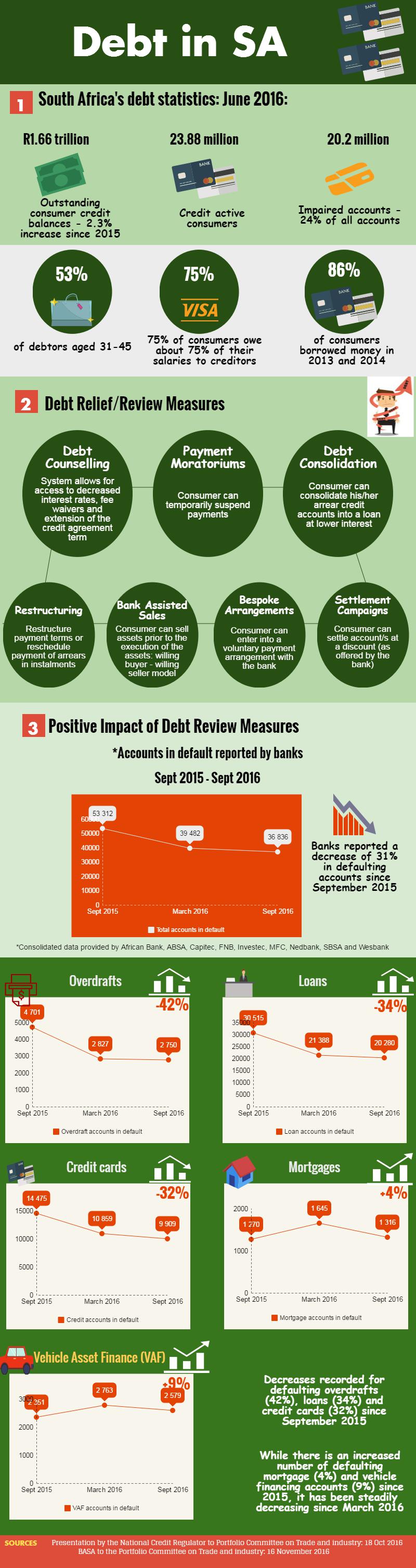

BASA believes a consumer’s personal circumstances will determine which of the six available debt relief measures is suited to that specific consumer. BASA noted the impact of each of these debt relief measures have for consumers.

South African debt statistics showed that:

- 23.8 million South Africans are credit active consumers

- Outstanding consumer credit balances increased by 2.3% since last year and now stands at R1.66 trillion

- Impaired accounts increased slightly since last year to 20.2 million currently

- 53% of consumers who take out debt are between the ages of 31-45

- 75% of consumers owe about 75% of their salaries to creditors

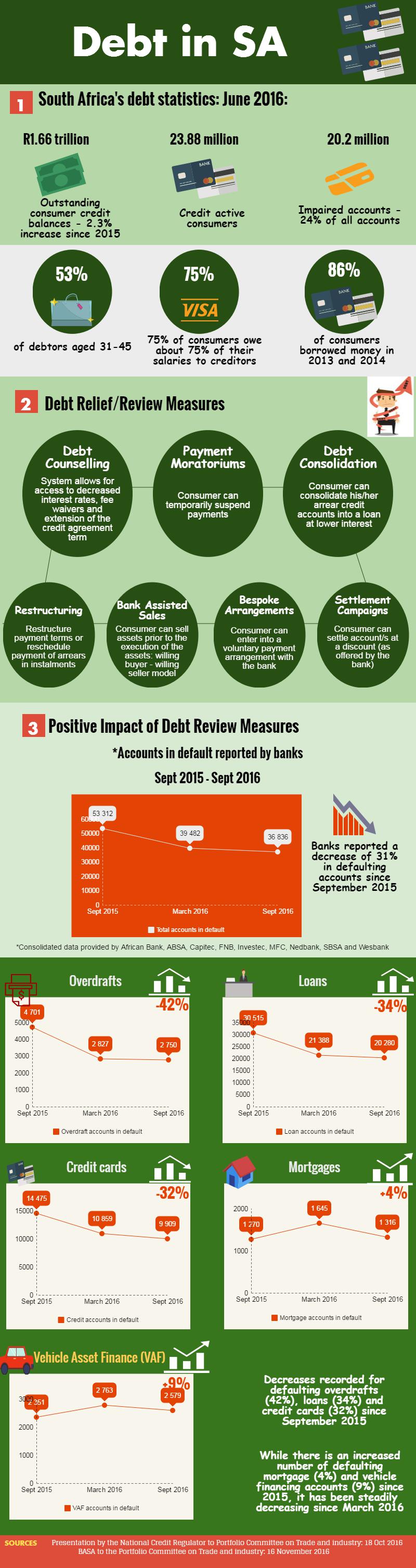

See infographic below for more debt statistics and the impact of debt review measures:

Comments

Keep comments free of racism, sexism, homophobia and abusive language. People's Assembly reserves the right to delete and edit comments

(For newest comments first please choose 'Newest' from the 'Sort by' dropdown below.)