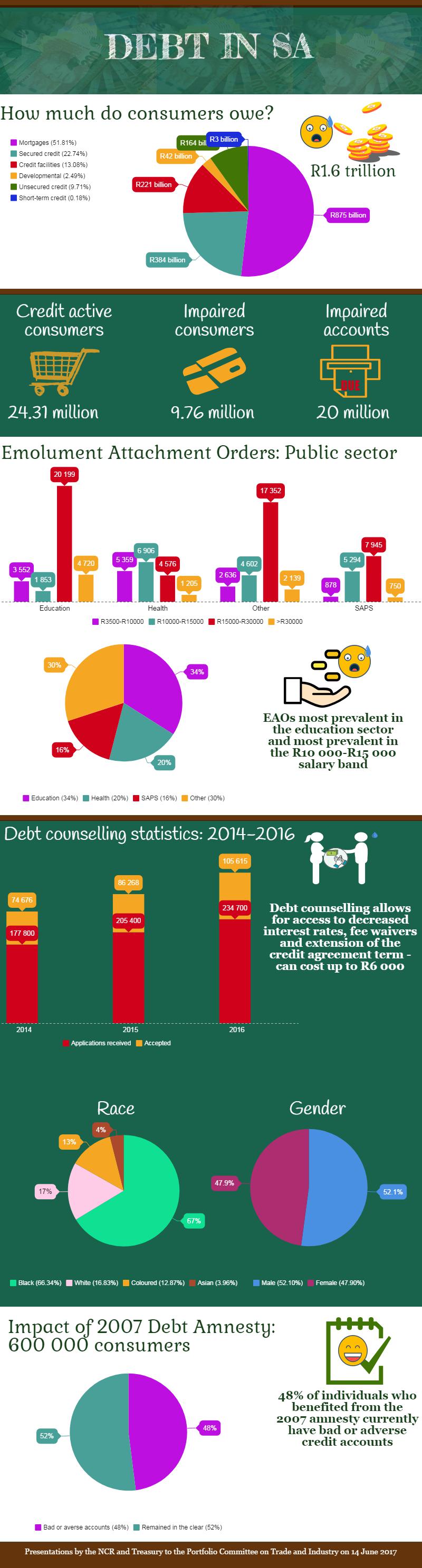

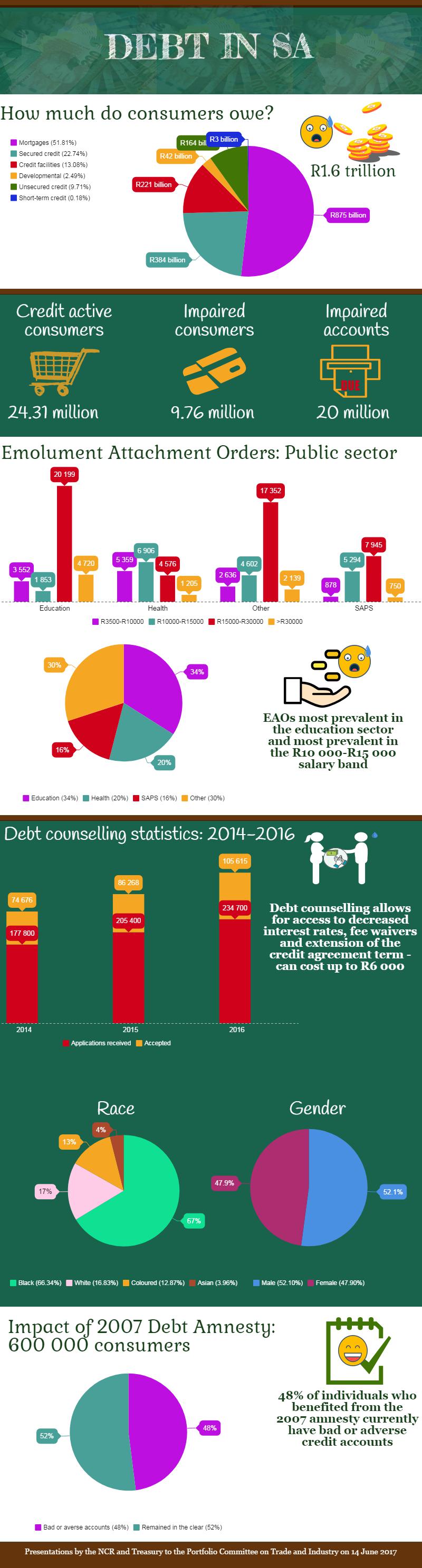

The National Credit Regulator (NCR) and National Treasury briefed the Portfolio Committee on Trade and Industry on over-indebtedness in South Africa and on the debt relief measures under consideration. On 31 December 2016, there were 24.31 million credit active consumer of which 40% (9.76 million) are classified as impaired consumers. The 24.31 million credit active consumers have 82.42 million consumer accounts with 76% in good standing and 24% impaired. This means that every credit consumer has an average of 4 credit agreements at a time. The options for an over-indebted person is debt review/debt counselling, administration or voluntary sequestration. Debt counselling allows for access to decreased interest rates, fee waivers and extension of the credit agreement term, but it can cost up to R6 000 in fees. Debt counseling statistics show the following:

- Most over-indebted consumers are within the ages of 36-45 with males being the most over-indebted (52%)

- 67% of over-indebted consumers are Black African, followed by whites (16%), coloureds (13%) and Asians (4%)

- Emolument attachment orders are most prevalent in the education sector and most prevalent in the R10 000-R15 000 salary band

Looking at the first amnesty intervention in 2007, data on 600 000 consumers show that 64% of individuals who benefited from the amnesty subsequently opened accounts; 74% of individuals who had obtained credit had bad or adverse accounts and 19% had judgments five years thereafter. Treasury was doing a spending behaviour analysis to have a more accurate understanding of consumer spending behaviour to inform the best debt relief interventions that will have a long term impact on spending and borrowing behaviour.

See infographic below for more:

Comments

Keep comments free of racism, sexism, homophobia and abusive language. People's Assembly reserves the right to delete and edit comments

(For newest comments first please choose 'Newest' from the 'Sort by' dropdown below.)